Toledo, OH - The Unexpected House Flipping Dream

Honestly, I would have never guessed that this market is actually not great for rental investments, but it is really strong for fixes and flips. Who knew?!

Here is the scoop:

About this Market: Toledo, OH emerges as a prime market for property flipping, thanks to its combination of affordable purchase prices, economic revitalization, and strong rental demand. The city's ongoing cultural and economic resurgence, supported by proactive local government incentives, enhances property values and attracts a growing population. Strategic geographical positioning near major Midwest cities further amplifies Toledo's appeal, offering investors significant ROI potential through both immediate flips and long-term rental strategies. With its diverse economic base stabilizing the rental market and a community-centric revitalization in full swing, Toledo stands out as a surprisingly lucrative market for real estate investors looking to maximize their investments.

Market Trends and Growth

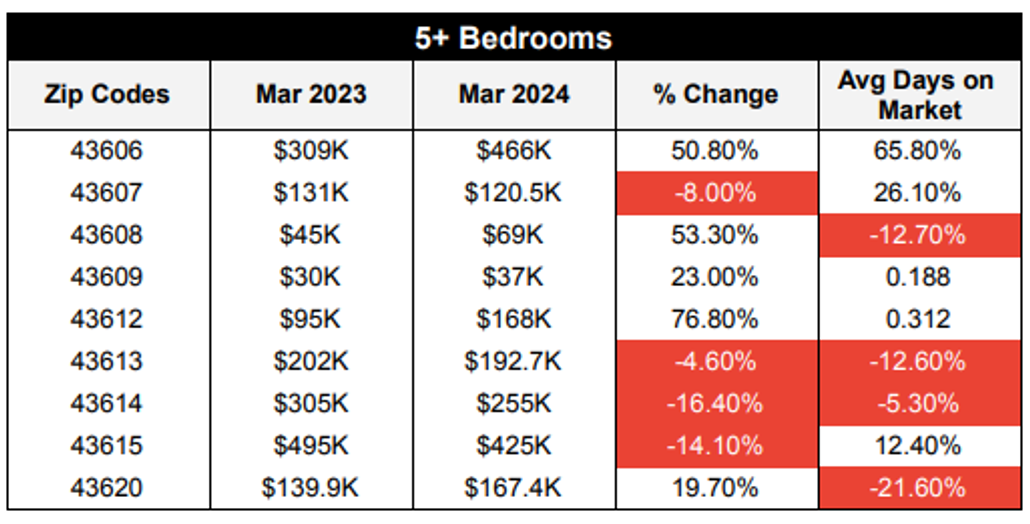

Price Growth in 43620

- Homes with 5+ Bedrooms: In the past year, these properties have shown a substantial increase in median sold prices, rising from $139.9K to $167.4K, a growth of 19.7%. This indicates a strong market demand and a promising opportunity for investors.

Days on the Market (DOM)

- Reduced Sale Time: The average sale duration has decreased from 86 days to 67 days year-over-year. This improvement suggests a growing buyer interest and possibly limited inventory, creating favorable conditions for quick turnovers.

Toledo OH - RE Analysis (April 2024) - House Sales (1).pdf

Demographics and Economic Factors

Population and Economic Characteristics

- Population Size: With a smaller population of 5,341, 43620 offers less competition in buying and selling, which is beneficial for flippers targeting niche market needs.

- Income Levels: The lower median household income ($27,442) suggests a demand for affordable, refurbished homes—ideal for flipping projects aimed at cost-sensitive buyers.

Housing and Ownership Trends

- Renter-Occupied Properties: A high percentage (68%) of renter-occupied properties indicates a transient population, potentially less targeted for flipping. However, converting these into desirable, owner-occupied homes could capture untapped market segments, particularly as economic conditions improve.

Age Distribution and Market Demand

- Diverse Age Groups: The presence of young adults and an aging population suggests varied housing needs—from starter homes to downsizing options. Tailoring renovations to these demographics can maximize appeal and marketability.

Comparative Analysis with Surrounding Zip Codes

- 43613 and 43615: These areas, with higher median incomes, might offer opportunities for higher-end flips but may also face stronger competition and higher property costs.

- 43606 and 43608: While the potential exists, these zip codes may not experience the same level of market appreciation as 43620, which could affect profit margins.

Strategic Recommendations

Investment Focus in 43620

- Cost-Effective Renovations: Focus on upgrades that enhance fundamental property values, such as kitchen and bathroom remodels and improvements in curb appeal. These will likely attract both renters looking to become homeowners and first-time buyers seeking affordable options.

- Target Market: Position properties to appeal to the existing rental demographic and potential homeowners by offering competitively priced, well-renovated homes.

The big flip, but remember the 70% rule of flipping: 2032 Robinwood Ave, Toledo, 43620

This is the type of home that would work perfectly for the demand; however, it should be converted to a multifamily property, most likely a triplex. The most recent comp to sell was 2114 Robinwood Ave, Toledo, 43620, which was converted to a Triplex and sold on 8/4/2023.

Ensure that the purchase and renovation costs adhere to the 70% rule relative to the after-repair value (ARV), which is estimated at $250K for sound investment planning.

Thanks for reading. Feedback (good and bad) is a compliment, so feel free to drop me a line!

Thanks Frank! :)